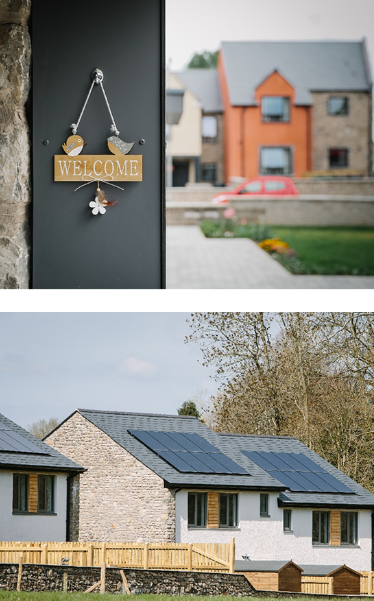

Shared Ownership

What is shared ownership?

Shared Ownership is an affordable home ownership scheme which allows individuals the chance to purchase a share of a brand-new property for 25% – 75% of their market value with rent payable on the rest.

What are the benefits?

- Savings Applicants only require a mortgage deposit on the portion theyre purchasing and not the full market value of the home, making the initial costs more affordable.

- Opportunity – Shared Ownership is designed to be accessible, enabling a wide range of applicants to get on the housing ladder. Most developments also facilitate the purchasing of further shares, providing the opportunity to move toward outright home ownership.

Am I eligible?

Shared ownership is available for most people to apply for in a variety of circumstances, including first time buyers, growing families and those who cant afford to purchase a home outright on the open market.

Each scheme has its own eligibility criteria. These include but may not be restricted to:

- Local connection – you will be asked to provide evidence of your connection to a certain Parish in the area surrounding the home.

- Financial requirements To qualify an applicant must:

- Not be able to afford to buy suitable accommodation at open market value

- Earn less than £80,000 annually as a household

- Prove they are not in mortgage or rent arrears

Owner occupiers can, in exceptional cases, have access to the scheme subject to certain conditions. Each of these applications will be assessed on a case by case basis, however applicants are ALWAYS required to have already sold their property or sell their property at the same time as buying through shared ownership.

All shared ownership properties available are advertised under each proposed development which can be found here.

Staircasing

After purchasing your initial share in your property, you will be able to increase this share in the future if you wish. This incremental increase is known as staircasing. The greater the share you buy in your home the less rent you will pay to South Lakes Housing. Please note that the price of additional shares will be based on the market value of the property at the time of staircasing, and not on the market value at the time of the original purchase. You can find further information in the Government’s Capital Funding Guide at https://www.gov.uk/guidance/capital-funding-guide

To request more information about any of the above please contact sales@southlakeshousing.co.uk